Student Loan Debt: The Really F*cking Scary Number Hidden in the NY Fed Report

There's been quite a bit of chatter about the latest report on student loan debt out by the New York Federal Reserve Board. You can check out a PDF of the findings here. All the bad numbers are up: the total amount of student loan debt, the number of students taking out loans, and the number of those who have stopped repayment. But there's one figure that I haven't seen many people in the news really highlight, and it's the scariest. It's also buried in the second half of the report.

First off, the expected bad news:

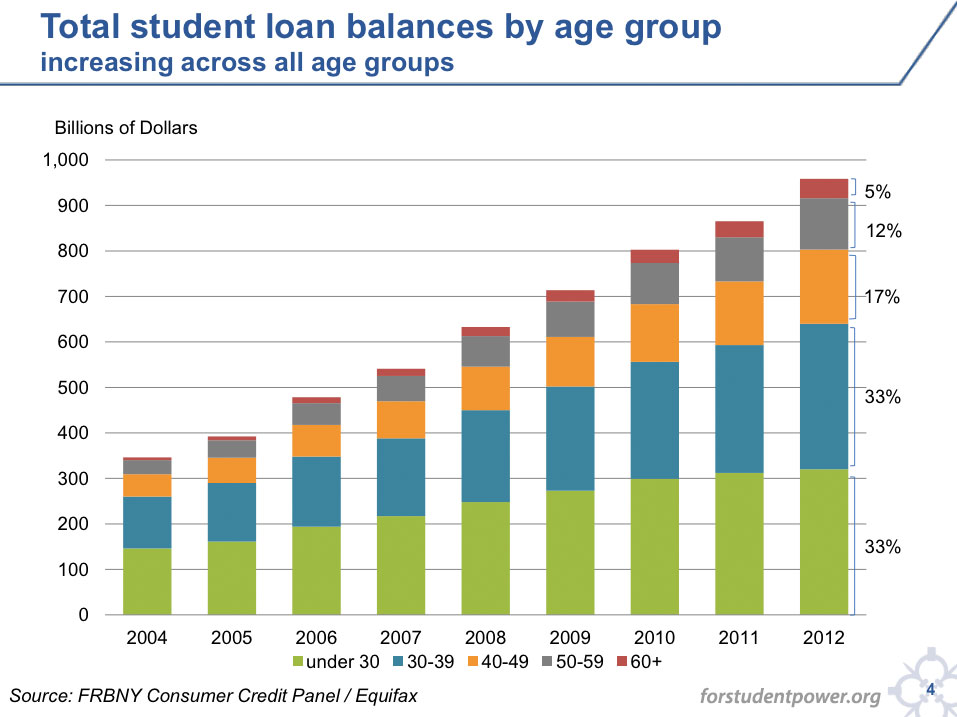

Everyone across age groups now has significantly more student loan debt

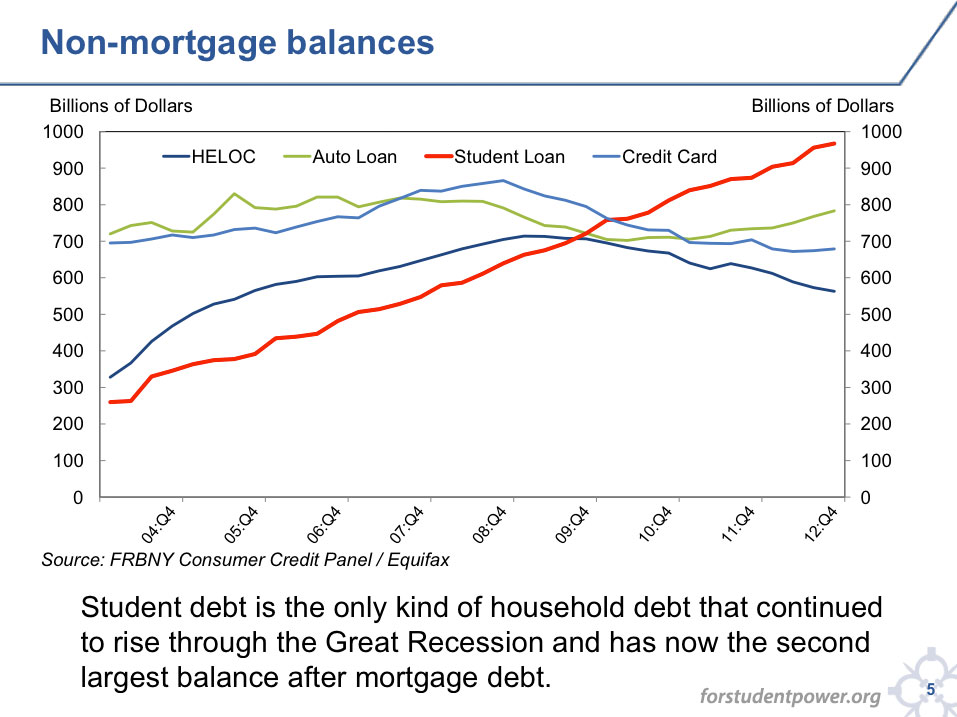

Student loan debt is the only kind of debt that's consistently increased during the recession:

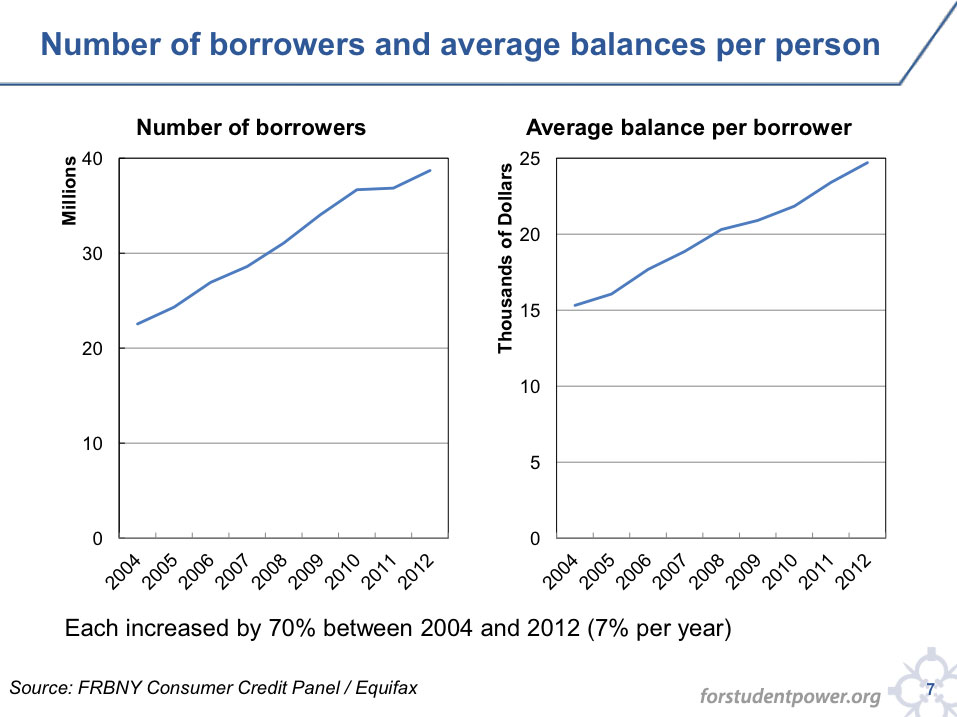

There are a ton more borrowers, and the amount they're borrowing has leaped as well:

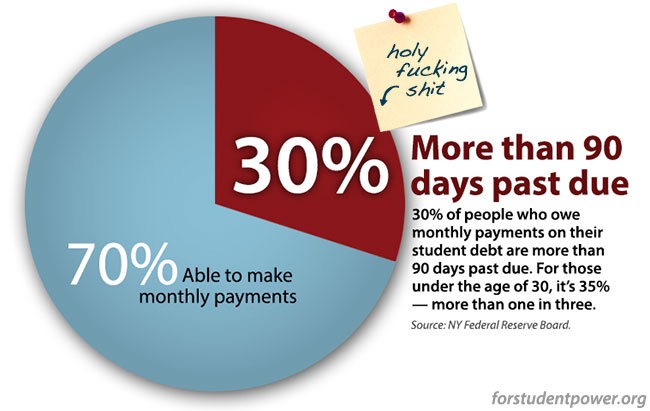

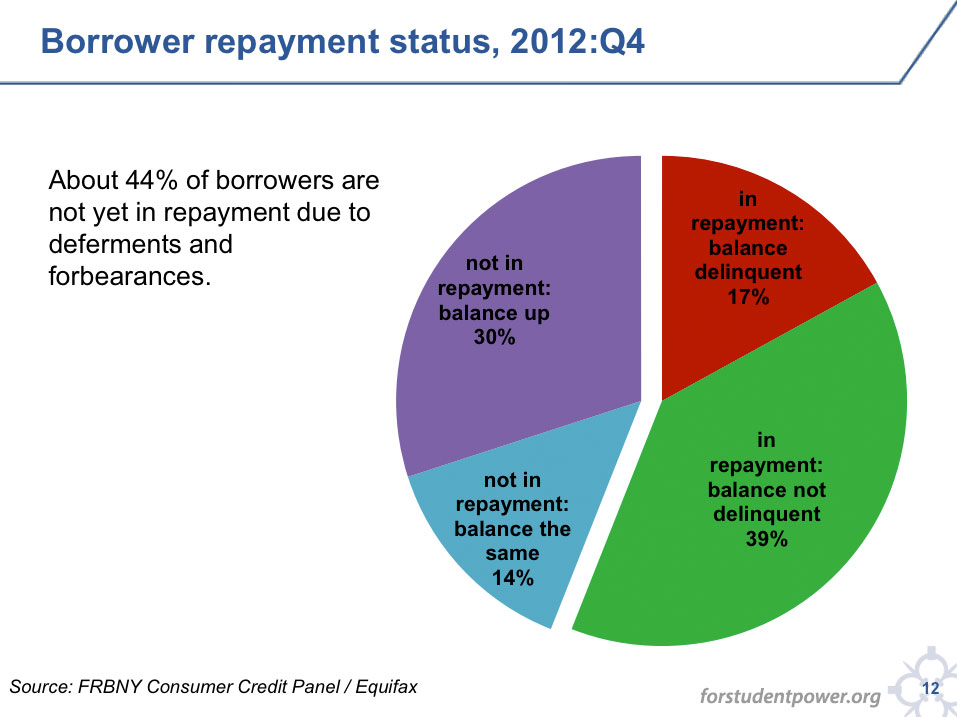

Now here comes the truly scary part you've been waiting for. Below is a pie chart of those who have student loans, and what their repayment status is.

At first glance, the percentage of those with delinquent balances seems pretty bad — 17%, one in six — but not the end of the world. But as the report casually mentions later in the report, this chart is deceptive in that it includes people who are not expected to make a monthly payment: either they're in school, or have a deferment or forbearance. So if we take those people out of the equation (the blue and purple slices), that modest 17% becomes a gigantic 30%! Join me in the next paragraph, as I reiterate this for dramatic effect.

ALMOST ONE OUT OF EVERY THREE PEOPLE WITH STUDENT LOANS DUE HAVEN'T PAID UP FOR MORE THAN 90 DAYS.

The Fed didn't create a pie chart highlighting this, so I went ahead and made one, because this is the number that shows how unsustainable our current system is. With other forms of debt, it's easy to see the breaking point: look at the bankruptcies. However, since Congress loves its Wall Street benefactors so much, student loan debt is (with very few exceptions) not dischargeable in bankruptcy. The 90+ day delinquency rate is the variable to watch for student debt.

Share this graphic on Facebook.

If you haven't already begun organizing to wrench power away from those who are actively putting you in financial shackles, I reckon you ought to start.